According to a recent report by Zillow, Home values in the United States have finally reached the bottom. Now, our first reaction to that is skepticism, however the basis for the evaluation and statement is Zillow’s Home Value Index. The annual ZHVI actually rose for the first time since 2007. It didn’t increase by much, just 0.2 percent, but combined with the fact that home values have risen for four consecutive months, it might be a good indicator that we are now heading out of the market drop and housing has hit 5-year bottom.

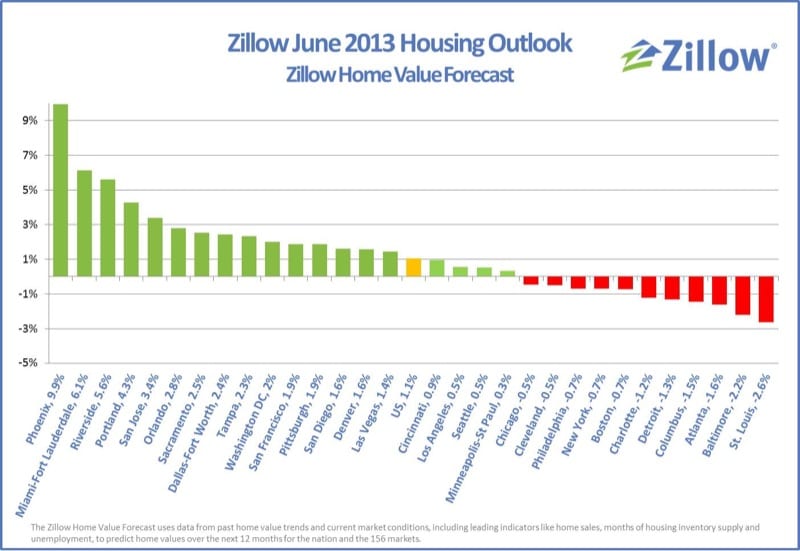

Almost a third of the 167 cities covered by the Real Estate Market Report, posted an annual increase in reported home values. As you might guess, some of the largest gains came from some of the most dramatically affected areas, such as Phoenix and Miami. According to Zillow, 40% of markets should see increases in home values over the next year. They even made some predictions which look to be very encouraging so far.

“After 4 months with rising home values and increasingly positive forecast data, it seems clear that the country has hit a bottom in home values. The housing recovery is holding together despite lower-than-expected job growth, indicating that it has some organic strength of its own. Of course, there is still some risk as we look down the foreclosure pipeline and see foreclosure starts picking up. This will translate into more homes on the market by the end of the year, but we think demand will rise to absorb that, particularly in markets where there are acute inventory shortages now. Looking forward, we expect home values to remain relatively flat as the market works through a backlog of foreclosures and high rates of negative equity.”

– Zillow Chief Economist Dr. Stan Humphries

Housing Has Hit 5-year Bottom

Foreclosures remain the big unknown factor, with some sources claiming that banks are holding onto large numbers of homes and leaking them out over time in order to not flood the market and drive down prices even further. While that’s something we can’t really verify, what we can observe is that the amount of reported foreclosures does seem to far exceed the number of bank-owned homes hitting the market in many municipalities. Rather than any sort of devious manipulation, however, some of that may be due to the fact that It takes, in Florida for example, an average of 861 days to complete a foreclosure. That’s going to create a backlog.

Zillow reports, encouragingly, that foreclosures are continuing to fall. The number now stands at around 5.8 out of every 10,000 homes being lost to foreclosure in June. To get this into perspective, In January 7.9 out of every 10,000 homes were lost to foreclosure – that’s roughly 27% drop. Probably the biggest indicator, in my opinion, is the drop in foreclosure re-sales (currently around 15% of all homes sold are a result of a foreclosure). These are homes that are sold as a direct result of a foreclosure. When these numbers drop further, we’ll start seeing a resurgence in new home construction – or at least that’s what we’re all hoping.

Check out the full interactive national report at the Zillow website.