If you’re reading this, you likely have some sort of stake or interest in watching the Fed rate rise—and along with it—mortgage rates. A rising Fed rate causes many people to wonder whether to buy, sell, or just crawl under a rock and wait for clearer skies. We don’t recommend that approach. Whether you’re in the business of new construction or remodeling, understanding how the rising Fed rate affects your business helps with proper planning and selling.

Table of Contents

- What is the Fed (Federal Reserve System) and the Fed Rate?

- How the Rising Fed Rate Affects Construction

- How Does the Fed Rate Affect Inflation?

- How a Rising Fed Rate Affects Hiring?

- Watch Those Credit Cards

- Do You Really Need a New Truck?

- Remodelers Will Feel it More

- Educate Your New Construction Clients

- Be Flexible

- How Do I Protect Myself Against Inflation? Escalation Clauses.

What is the Fed (Federal Reserve System) and the Fed Rate?

The Federal Reserve System, often referred to as the Federal Reserve or simply “the Fed,” is the central bank of the United States. It was created by Congress in 1913 to provide the nation with a “safer, more flexible, and more stable monetary and financial system”.

The Federal Reserve conducts the nation’s monetary policy by influencing money and credit conditions in the economy for purposes of stability. It supervises and regulates banks and other important financial institutions. It contains systemic risk that may arise in financial markets. Finally, it plays a major role in operating and overseeing the nation’s payment systems.

The Fed rate is the percentage rate that banks lend reserve money to each other overnight to maintain minimum reserve requirements. Why we pay attention to it in the housing industry is that a rising Fed rate has a rippling effect.

How the Rising Fed Rate Affects Construction

The Fed rate can do a lot of things. A rising fed rate in particular affects the construction industry alongside other industries. Principally, raising the Fed rate can help slow inflation. As that goal contributes toward less spending and more saving—it can reduce some construction-related spending.

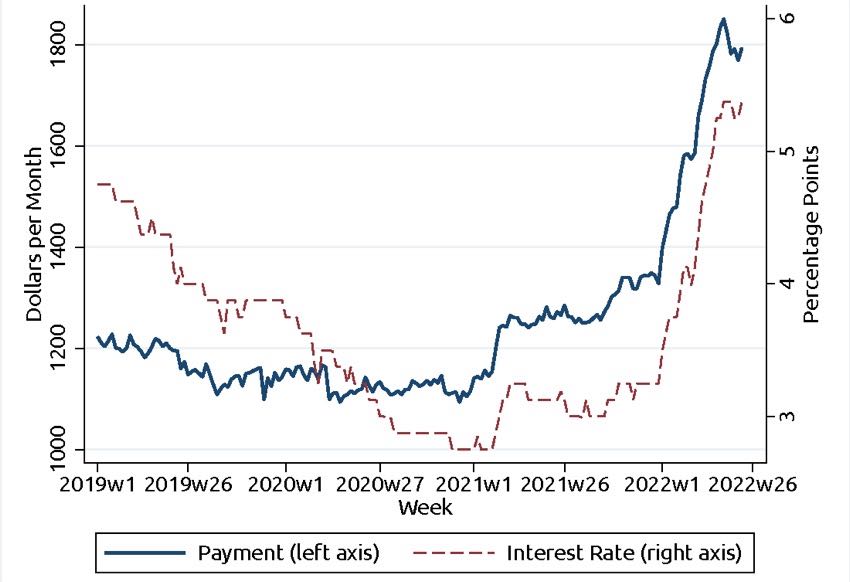

Another thing the Fed rate does is bring up other rates tied directly to it. For example, the Fed rate directly affects credit card interest rates. It also drives up (or down) mortgage-backed securities. These, in turn, drive mortgage rates. And there’s the rub. As the Fed rate goes up, mortgage rates climb. When mortgage rates climb, monthly payments go up and the amount of house you can afford drops—often significantly. We call this a reduction in a buyer’s “purchasing power”.

| Mortgage Interest Rate | $360,000 | $380,000 | $400,000 |

|---|---|---|---|

| 4.75% | $1,878 | $1,982 | $2,087 |

| 5% | $1,933 | $2,040 | $2,147 |

| 5.25% | $1,988 | $2,098 | $2,209 |

| 5.5% | $2,044 | $2,158 | $2,271 |

| 5.75% | $2,101 | $2,218 | $2,334 |

| 6% | $2,158 | $2,278 | $2,398 |

Other things that a rising Fed rate affects include hiring—which may get a little easier. When the Fed attempts to slow the economy by raising rates, this often causes some additional unemployment and/or salary freezes. When that happens, people can find new motivation to find work elsewhere.

Because mortgage rates go up with the Fed rate, some construction projects can experience significant issues related to closing and financing. The underwriting process can create havok if borrowers don’t have a rate locked in early.

Consider adding escalation clauses

How Does the Fed Rate Affect Inflation?

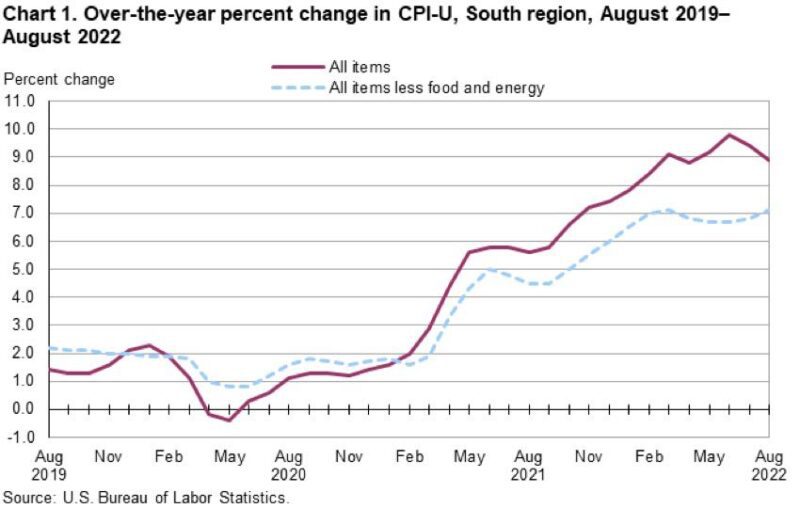

In a strong economy where people are making money hand over fist, a rising Fed rate slows things down. It’s not that they don’t want you making money, it’s that they don’t want consumer prices to shoot up so quickly that they get out of control. After all, who wants to pay $100 for a loaf of bread? June 2022 saw the highest 12-month inflation increase (9.1%) since the 12-month period ending November 1981.

When money is easily acquired, pricing tends to rise. Agree or not, the Fed raises uses its control over the prime rate to counteract that tendency. Unfortunately, they tend to lag in their rate hikes and carry those hikes too far and too long.

How a Rising Fed Rate Affects Hiring?

Hiring typically gets a boost from a rising Fed rate. If your construction business is in good financial shape, Fed rate increases may help you fill jobs. As it slows the economy, hiring slows, and potential employees don’t have nearly as many options. When the economy makes working easy, you may end up paying $30 an hour for a new guy with no experience. When rates go up and jobs stagnate, that same worker make take a job at $18 an hour—particularly in a role where he feels valued.

Watch Those Credit Cards

The Fed rate affects short-term debt most of all, and credit card rates are tied directly to it via the prime rate. If you operate your business from a credit card and don’t pay it off every month, your interest payments follow those rising prime rates.

When it looks like rates may go up, take a look at the ramifications on your business and whether you can afford to pay down some of your debt.

Do You Really Need a New Truck?

Like credit cards, auto loans and bank loans relate to the prime rate. This is tied closely with the Fed rate. You’ll have to pay back a lower interest rate on loans when the Fed rate is low. If the rate rises, lock that loan in soon or wait and pay cash when you can afford it.

Remodelers Will Feel it More

If your client base includes a large number of people using a home equity loan to cover their remodeling or renovation costs, any Fed rate increases affect you even more. HELOC (home equity line of credit) is in the same boat as credit cards and auto loans. Banks and lenders tie them to the prime rate. As the Fed rate goes up or down, so does that HELOC rate.

Relatively speaking, money is still cheap on a historical level. Talk about the “opportunity cost” of waiting with your clients and see if you can get ahead of the curve.

Educate Your New Construction Clients

There’s a common fear that the Fed rate drives mortgage rates, but the truth is that there’s very little direct effect. Mortgage rates stayed pretty stable in 2017 despite three Fed rate hikes. They rose roughly a point in 2018 after four more hikes.

Mortgage-backed securities—where your mortgage and thousands of others get wrapped up together in an investment vehicle—drive mortgage rates much more directly. If buyers find these less attractive, rates need to increase to offer a better return for the investors.

Be Flexible

Nothing stalls home sales like fear. If you target higher-value homes, you may include features that other builders consider upgrades. Pull back on that some to offer a lower starting price. Your buyers will feel like they’re getting a good value and have the mindset to buy upgrades.

Builders need to keep an eye on the market. Know what’s going on in terms of how easy it is to get loans, and how much people are willing to spend on new homes. A small amount of awareness helps you distance yourself from competitors who may be tone-deaf to the economy.

How Do I Protect Myself Against Inflation? Escalation Clauses.

One of the major unknowns for the housing industry center on how rising Fed rates interact with tariffs. For construction materials not purchased right after everyone signs the contract, consider including an escalation clause.

Editors Note: Escalation clauses help protect your bottom line. They ensure a slowing market doesn’t negatively affect the contracts you put in place prior to a downturn or rise in material costs. If costs go up, they kick in to allow you to adjust the contract accordingly.

In 2020, this became a huge issue when the pandemic all but halted overseas shipments. Add in trade issues, security concerns, and a couple of really bad manufacturing fires, and we saw huge spikes in everything from building materials to vehicles and consumer electronics.

One big thing to note here: Don’t act embarrassed or feel like you need to beat around the bush with escalation clauses. Explain to your client why it’s there and be upfront about it. Be prepared to at least discuss alternative materials that you can source from the USA and won’t go up in price due to tariffs.