For as long as people have been investing, markets have defied logic—in one direction or the other. Housing and the stock market sometimes coincide. At other times., they seem to diverge. At some point, you want some sort of understanding of what to expect and how to prepare your business and/or investments. More specifically, we want to know: Does the stock market affect housing?

Selling Stocks or Selling Houses?

Since the stock and housing bust of 2008, investors have really only seen this type of selling on occasion. Notably, it occurred during the Brexit vote and then again on the eve of the 2016 U.S. election. Even then, that selling lasted literally overnight and was reversed and overtaken in a handful of days. Markets lull many of us to sleep with the false promise that they never go down.

Indeed, there’s a generation of young investors—teenagers during the 2008 bust—who now have jobs, incomes, and families who have never seen prices materially fall. Likewise, if they’ve purchased homes, they’ve probably only seen the values increase.

But back in ’08, stocks and housing fell together—a lot. And now, because we love the tools that build stuff, we want to stay aware. More particularly, we’re wondering how the stock market affects housing and construction.

Or vice versa I suppose.

In the case of the 2008 crash, the housing market bubble drove down stock prices—for a bit. That was also an extreme example. What about “normal” markets? Is there such a thing?

Typically Rising Assets

A memorable demotivational poster says that “Economics is the science of explaining tomorrow why the predictions you made yesterday didn’t come true today.” If the folks who spend their careers studying the dismal science have drastically different opinions, then what’s the value of another opinion from a “non-expert?”

Well, we can throw a dart at the wall as well as anyone!

Seriously, though, before any of us need to get talked off the ledge, it’s important to remember that price corrections in any risk assets—stocks, real estate, even cryptocurrencies—are normal. With prices constantly rising, it’s actually been the last decade or so that’s been abnormal.

Market Corrections are Like Garage Sales

Markets normally have two sides, with some give and take whether they are trending higher or lower. Although those corrections can be unsettling, they are arguably good. Don’t we all like getting a good deal?

Corrections give us the opportunity.

It is rarely wise to buy something when it’s at its highest price. Sir John Templeton and Warren Buffet made fortunes buying during corrections.

But that still doesn’t get us to the real question. For those of us whose livelihood comes from construction, who’ve seen the seeming link between stocks and housing, what do we need to pay attention to?

Lining Up the Graphs

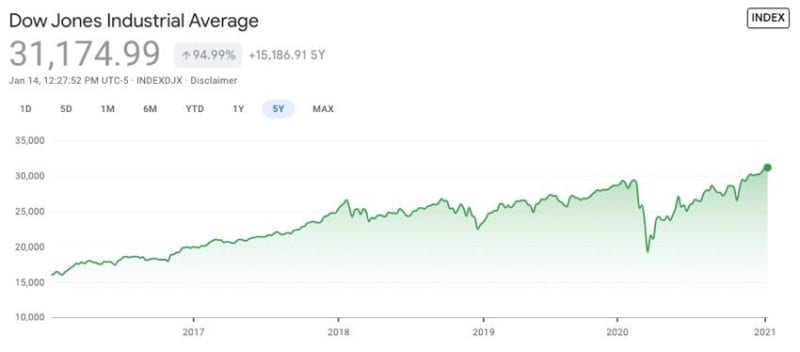

Well, given that corrections are historically normal, we don’t think there’s a reason to worry unless stocks fall dramatically. This would signal more economic weakness than a run-of-the-mill correction that we see from time to time. However, economies ebb and flow. While we can’t say there’s a direct link between stocks and housing, let’s take a look at the past 20 years.

Here are the past 20 years of the DJIA in chart form sourced from Macrotrends and edited for size and display:

Now let’s look at the Case-Shiller Price Index which we sourced from the Federal Reserve Bank of St. Louis) for housing during the same period. It takes a composite of single-family home price indices:

And now let’s put them together to see if we get any correlation:

To us, it looks more likely that speculators in risk assets flock together. That is, investors seek a return across risk assets at the same time, so a correction in one asset class will likely happen in others as well.

When the froth comes off of stocks due to a dip in prices, one might be able to make the case that hard assets—real estate, homes, commodities—might even be a refuge for investors. Stocks can fall further and faster than things you can touch, walk on, live in, work in, etc. That seems to be reflected in the 20-year overlay above.

It seems likely that housing and construction will remain more stable than the stock of a company that allows us to send out squawks or chirps or just get mad at everyone we used to like.

Does the Stock Market Affect Housing? A Suspect and a Humble Theory

Speculative bubbles have appeared and popped for centuries. And people have always acted in their own self-interest. Still, it seems that bubbles have become more frequent and ferocious over the past couple of decades. We learned far too late that Internet opinions are a dicey proposition, but here’s one that might actually bring us all together instead of dividing us.

If it’s true that bubbles have always appeared, people have always been self-interested, and bubbles are both bigger and more frequent, we can bring into the lineup the Federal Reserve as a suspect. As the Greenspan-Bernanke-Yellen-Powell Fed thought that every natural economic correction should be met with cheaper money, it created a world awash in low, no, or even negative interest rates.

Since prudent savers could no longer expect a return by putting their savings in a bank, this money has sloshed around the world, frantically looking for a return—first in tech stocks, then in housing, then in oil, then (perhaps) in stocks generally, then most recently, in cryptocurrencies. Of course, some other bad policies aided the bubbles, too.

We must consider the possibility that interest rates might find a less bubble-friendly place to settle if they arrive through the billions of transactions occurring among millions of people instead of a handful of people in a room at the Eccles Building. We just might find that we wouldn’t have horror stories of jobs, retirement accounts, and home equity that we counted on vanishing into thin air.

Bottom Line: Does the Stock Market Affect Housing?

While the graphs provide a nice overlay, it’s unlikely that there’s a direct connection between stocks and housing. That’s good news for those of us in construction as we see stock markets fall. Housing may follow—but not quite as quickly. It also may bounce back more quickly as people look for a new place to put their investments.

Still, as confidence or insecurity in one area of the economy goes, so go the others. We have to remember that corrections, although rare over the last decade, are normal—and healthy. At the same time, we have to remember that corrections can adversely affect us and our neighbors. Economies don’t expand forever, so there’s likely at least a mild slowdown ahead. But if we keep our skills sharp and customers satisfied, we’ll be able to weather the storm.

So what do you think? Does the stock market affect housing? If you’ve been in the industry long enough to weather a couple of down markets, let us know what you’ve seen in the comments below!