I have a dear friend who happens to be an economist with a PhD from George Mason University (he also holds a BS in mechanical engineering from Virginia Tech, an MBA from the University of Florida, and is bar-certified with a law degree). He has maintained for years that renting a home is a viable choice—and I agree. It has offered him a flexibility unavailable to most homeowners. As if to prove his point, he’s literally traveled the globe, visiting all seven continents. If, however, we look solely at finances, the numbers tell a different story. The problem is that all existing calculators focus on monthly payments, rather than the true cost of renting versus buying and owning a home. In particular, they ignore equity.

To create a true cost comparison, we calculated the long-term cost of renting a $350,000 home in central Florida versus buying a comparable home. In truly pressure-testing the actual numbers, we had to build a fairly robust financial model. Going far beyond monthly payments, our model includes roof replacements, taxes, PMI, homeowner’s insurance, rent inflation, investment growth for renters, maintenance, home appreciation, and even deducting a realistic 7% cost when you eventually sell the home. For the renter, we also assume they invest the difference, including banking the $35,000 they saved by not having to put that money into a hefty down payment.

Are you ready? This is a long read, but it’s so worth it if you’ve ever wanted to compare the two options with a long-term investment in mind. Calculating your total costs of renting versus owning a home involves far more than simply figuring out the monthly payments over time.

Let’s Set Some Basic Assumptions

Before we even start to assess the true cost of renting vs buying, we need to go over some of the assumptions we made regarding our sample renter and owner. Without these, we’ll hardly have a fair comparison, and you won’t fully appreciate the calculations or results. The inclusion of these details—particularly those involving home equity—is what makes this a worthwhile exercise and different from any other comparison or calculator I’ve seen.

The Homeowner

- Home price: $350,000

- 10% down ($35,000)

- $315,000 mortgage at 6% APR

- PMI until LTV reaches 80% (~month 33)

- Property taxes: $2,500/year

- Extra maintenance: $1,000/year

- Homeowner’s insurance: $5,000/year

- Roof replacement: $15,000 at years 12 and 24

- Home appreciation: 3% annually

- 7% cost deducted upon sale

The Renter

- Initial rent: $2,275/month

- Renter’s insurance: $500/year

- Rent inflation: 3% annually

- Investment account starts with $35,000, which wasn’t spent on a down payment

- Investment growth: 6% annually (compounded daily)

- Adds any monthly savings vs. ownership

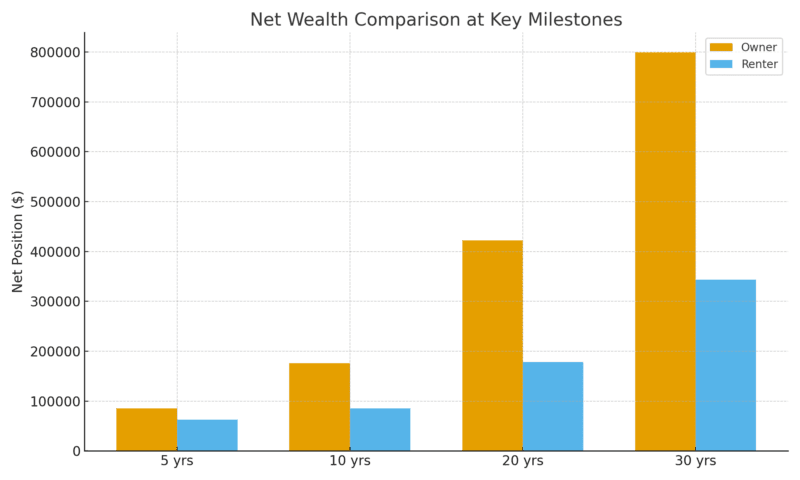

Net Worth After 5, 10, 20, and 30 Years

After running the complete model, we compared the final financial position of both. This represents the homeowner’s (HO) net worth after selling versus the renter’s (R) investment balance.

| Year | Homeowner (HO) Net After Sale | Renter (R) Net | Difference |

|---|---|---|---|

| 5 | $84,985 | $63,119 | +$21,866 (HO) |

| 10 | $175,605 | $85,200 | +$90,405 (HO) |

| 20 | $422,544 | $178,378 | +$244,166 (HO) |

| 30 | $799,702 | $343,560 | +$456,142 (HO) |

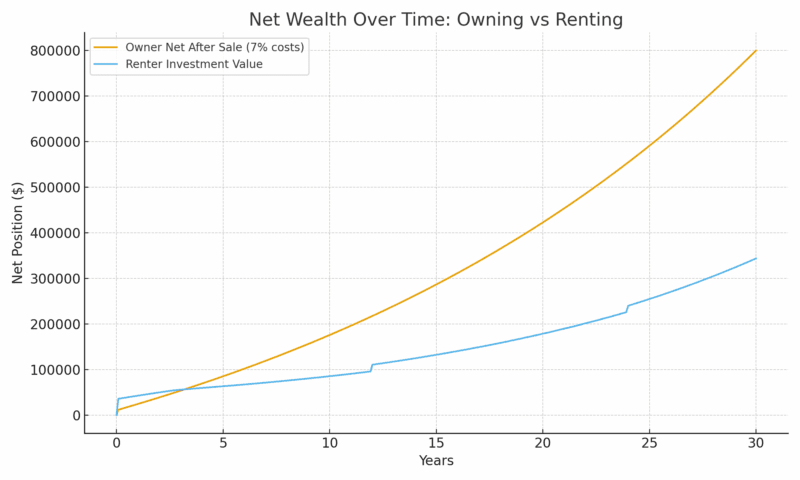

Net Wealth Over Time – The True Cost of Renting vs Buying

Even after property taxes, PMI, extra maintenance, two roof replacements, and higher insurance, the homeowner’s net long-term position is significantly stronger. This is largely due to leveraged equity growth and fixed mortgage payments versus rent inflation. Note that, in our calculations, we added the cost of a new roof to the Renter’s investment balance.

Milestone Comparison (Bar Chart)

It may look close at first, with the homeowner only being up by around $22,000 before needing a roof replacement. However, the gap continues to widen dramatically over time. By the time we hit 30 years, and the home mortgage is paid off, the homeowner is ahead by roughly $456,000. This represents the true cost of renting vs buying a home—or, rather, the actual benefits to homeownership.

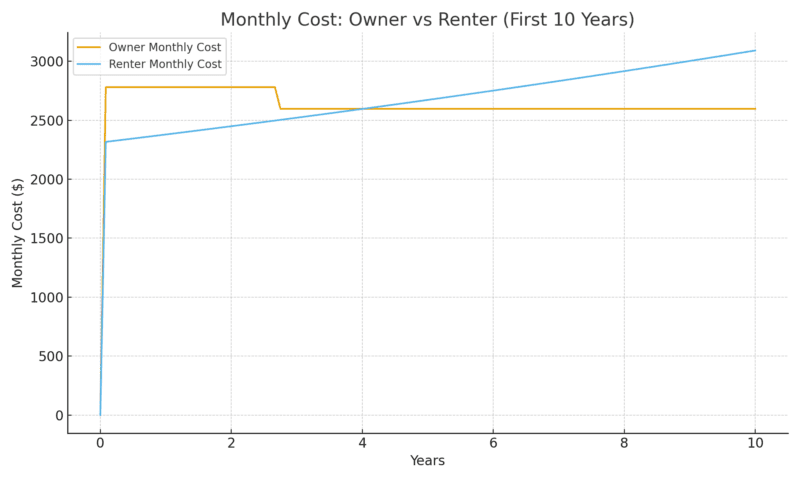

Monthly Cash Flow Comparison (First 10 Years)

The renter starts slightly ahead with respect to monthly cash flow. However, once PMI (private mortgage insurance) drops off, and rent continues to rise, the renter ends up spending more per month than the homeowner, who has a fixed mortgage payment. Believe it or not, with our assumptions, this occurs around year four. This quickly puts the renter in a position where they can no longer invest a net difference in monthly payments. From there, homeownership just continues to show benefits.

Final Thoughts on the True Cost of Renting vs Buying

When analyzed in greater detail—not merely comparing monthly payments—homeownership consistently outperforms renting over the long term. This holds true despite higher insurance, maintenance expenses, roof replacements, and transaction costs. This is where the true cost of renting a home versus buying a home really shows up. You may have some different assumptions that will yield slightly different numbers, but it will be hard to make a case for renting being a financially better choice over a long period of time.

With that said, I don’t believe at all that renting is “throwing money away.” It absolutely offers lifestyle flexibility and reduced responsibilities with respect to homeownership. But financially, at least in this central Florida example, homeownership creates substantially more wealth across every 5-, 10-, 20-, and 30-year period.

Agree with our assessment? Disagree? Did we miss anything (like factoring in eventual remodeling costs)? Let us know in the comments below—we’d love to hear from you!